Silicon Valley is the fintech capital of the world. London is the fintech capital of Europe. After the Brexit vote, the rise of fintech in UK might be under a threat.

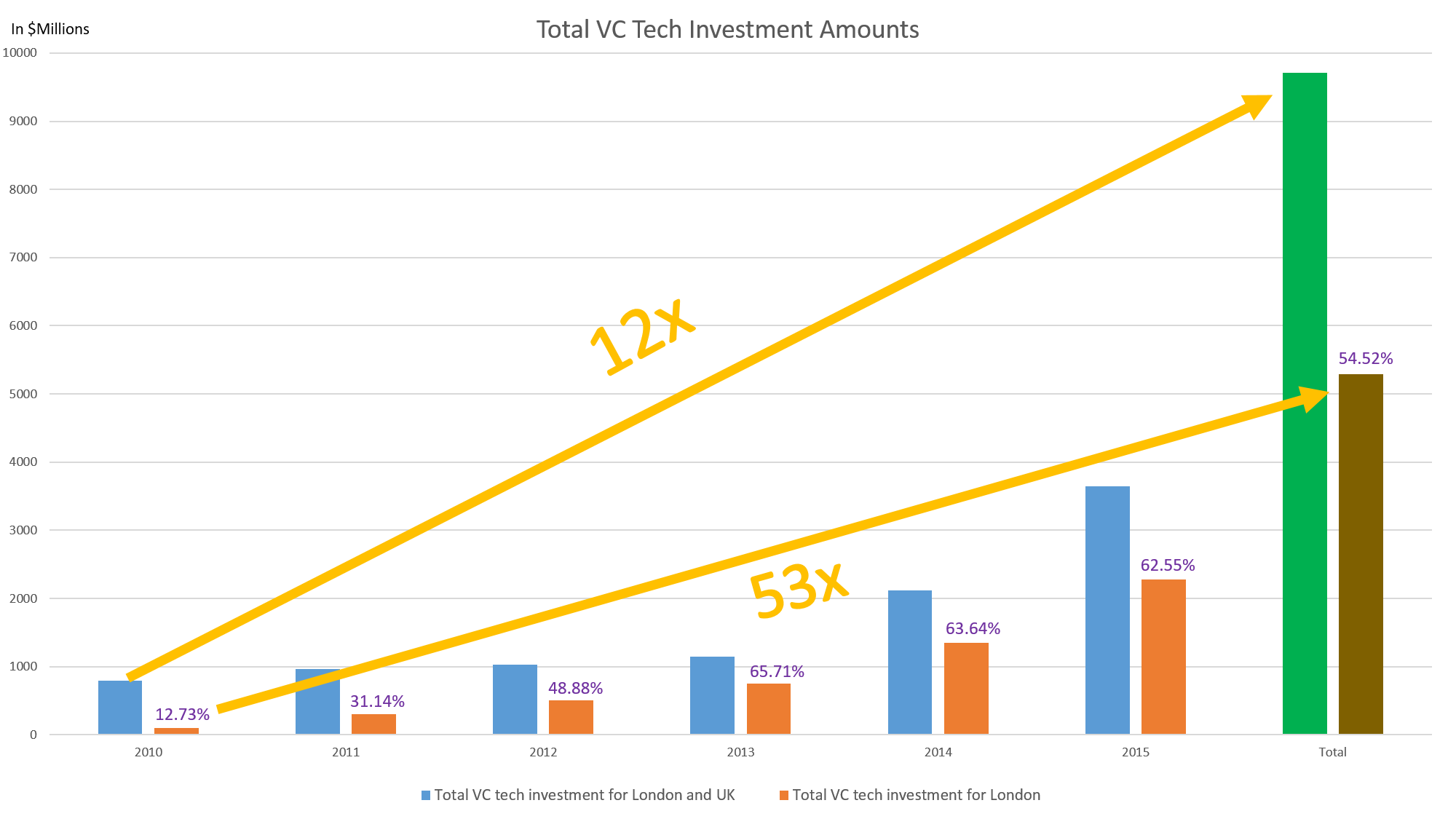

Total venture capital investment in technology for UK increased to over $3.6 billion in 2015, 71.43% increase from 2014. Of that, London-based tech start-ups accounted for 62.55%

In the last 5 years, UK technology companies have collectively raised $9.7 billion, with London-based companies accounting for 54.52% of it or $5.3 billion.

Since 2010, investment in the British firms soared over 12-fold, while investment in the London-based firms soared over 53-fold.

Brexit can halt the growth of UK fintech industry.

Why is that? UK could lose its “passport.”

Many companies in EU, including fintech, use mechanism known as “passporting” to access Europe (European Economic Area) by getting licensed in a EU nation and be able to sell their products/services across the bloc. If the passporting privilege is lost, companies will have to submit application in every single country it wishes to operate in, which is time consuming and cost prohibitive.

Not only fintech companies, but also international banks would have to find a new legal home base. Large U.S. banks, such as Goldman Sachs (GS), Citi (C), and JP Morgan (JPM), employing thousands of people, would have to move its operations to other cities, such as Paris or Frankfurt.

Fintech companies could take the same direction as the banks. It is possible they will move to Ireland (Dublin). Ireland is European home (EU base) to Apple (AAPL), Google (GOOGL, GOOG), Microsoft (MSFT), Dell, Twitter (TWTR), Airbnb, and more. The corporate tax rate, which is one of the most important part of Irish investment attraction, is 12.5%, one of the lowest in Europe. That’s very low compared to United Kingdom’s 20% rate and Europe average of 20.24%.

One other important part of Irish investment attraction is its KDB (Knowledge Development Box). Certain intellectual propriety income, such as patent/copyright, are subject to just 6.25% tax, half of its famous 12.5% corporate tax rate. Not only that, but there is also 25% tax credit for research and development spending.

The KDB is clearly aimed at incentivizing innovate R&D. It provides 50% deduction in tax rate from qualifying profits. In other words, 50% allowance. No wonder so many U.S. tech companies are using Ireland as their European base.

In Europe, overall fintech investment increased 120% between 2014 and 2015. The number of deals increased by 51%. Both should continue to increase as states like Ireland continue to attract start-ups and talent. However, if UK files for Article 50 and other EU members plans to follow the same path, it is very possible the increased uncertainty over the EU cartel will scare away start-ups and international investors.

There’s also the issue of free movement of labor. One in three UK start-up workers are outsiders. Of the 34% workers from outside the UK, 20.7% are from the EU. 66% hold UK passport. The most common non-UK nationalities were Irish, American, and Spanish.

Brexit is likely to make it costlier and complicated for start-ups to attract and retain talent. Will the UK allow the free movement of labor? I don’t think so. One-third of leave voters stated the main reason for wanting to leave the EU “offered the best chance for the UK to regain control over immigration and its own borders.” Plus, other EU members, such as Ireland, probably want start-ups and talents to come to their cities, not stay in the UK.

In 2014, financial and related services employed nearly 2.2 million people, 7% of the UK workforce. The industry contributed 11.8% of UK economic output in 2014. London, the financial center of the UK and the world, accounted for 714,000 of the employment.

The British fintech firms employ about 61,000 people (2015 data), 2.8% of the financial and related services employment and 5.7% of financial services employment (both of which 2014 data).

The stakes are definitely high here.

Peer-to-peer (P2P), money-transfer and payments start-ups would be hardest hit by Brexit and by the end of EU passporting.

In April 2015, London-based P2P lending company, Funding Circle secured the largest single deal of the year with a $150 million funding, valuing the startup at over $1 billion, going straight into the “unicorn” club, private companies valued at $1 billion or more. The company is online marketplace that allows investors to lend money to small and medium-sized businesses.

European Investment Bank (EIB) recently announced it would the platform to make 100 million pounds ($133.3 million) loans to UK firms. 20% of UK’s fintech firms focus on credit and lending, which P2P falls under. UK has 74.3% share of the whole EU alternative finance market, which particularly includes online alternative finance, from equity-based crowdfunding to P2P business lending and more.

In 2014, UK P2P business lending market size was 998 million euros ($1.1 trillion), 42.70% of total UK alternative finance market size. As I said above, “The stakes are definitely high here.”

Brexit could reduce lending, especially to 5.4 million small businesses in the UK accounting for 99.3% of all private sector business. Collectively small businesses account for 50% of GDP (Gross Domestic Product) and 60% of employment.

Many of these businesses will encounter financial problems, leading to layoffs of employees and so on (domino effect).

In addition to above, money-transfer and payments start-ups could also be hit hard as they will lose their “passporting” privilege. 54% of UK fintech firms focus on banking and payments. To sum up what I said about “passporting” above, if you’re regulated in UK, you’re regulated across the EU.

Other EU members, such as Ireland, will try to use Brexit to their advantage. They will try to make its laws more attractive to entice fintech firms away from London.

There is also chance the UK will get to keep its fintech firms, only if it differentiates itself with streamlined regulation, tax breaks, and increased support for innovation.

The UK will have to renegotiate the financial regulation with the EU. But I don’t believe they will get what they want. EU is already playing hard-ball. UK has more to lose than the EU.

Article 50 won’t likely be triggered until late this year or early next year. If by then, anti-Brexit campaign gains momentum and the presence of pro-remain politicians increase in the UK government, it is likely UK will not leave EU.

Feel free to read my previous article, Pros and Cons of Brexit.

If you have any views, I would love to know in the comments below. If you have any questions about any issues related to Brexit, I would be happy to answer them ASAP. Don’t be surprised if the answer is 5 paragraphs long. Thank you.