Look at the headlines.

At 17-years-old, Donald Trump was named a captain for his senior year at a military boarding school. Spending five years at New York Military Academy, the school taught Trump to channel his aggression into achievement.

Under the Trump budget, almost every budget increase goes to military departments, 10% increase Y/Y in the budget for military spending. It’s not a rocket science to figure out Trump madly loves force.

Even Trump’s Secretary of Defense loves force. Mad Dog James Mattis once said, “It’s fun to shoot some people. I’ll be right up there with you. I like brawling.”

At his confirmation hearing in January, Mattis said, “My belief is that we have to stay focused on the military that is so lethal that on the battlefield, it is the enemy’s longest day and worst day when they run into that force.”

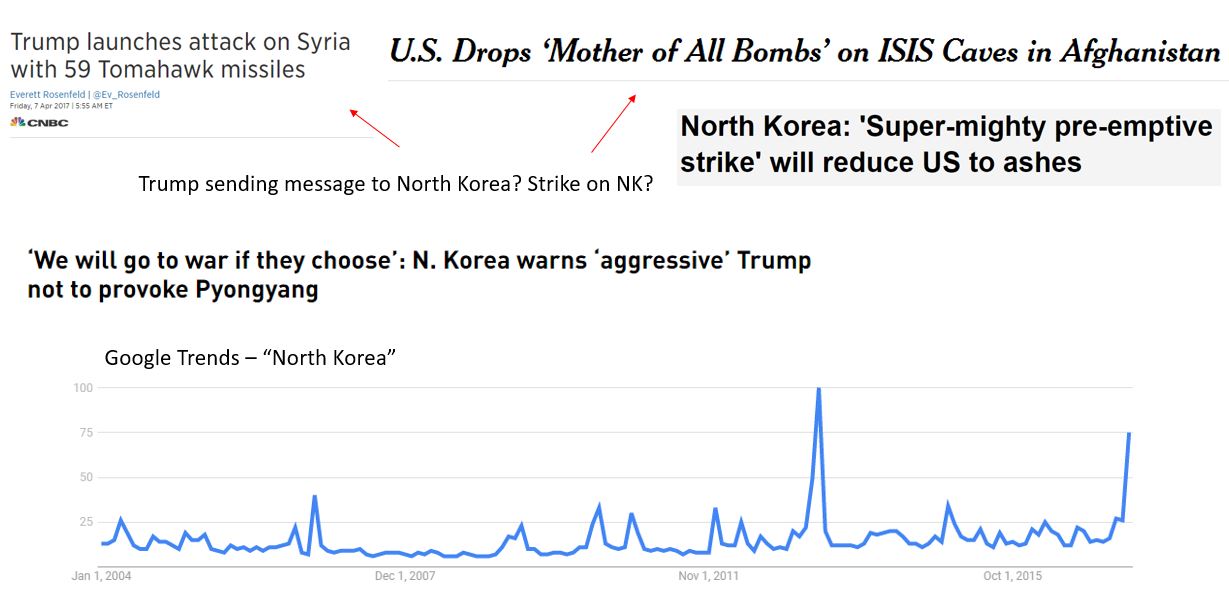

Then there came 59 Tomahawk missiles to military bases in Syria and “Mother of All Bombs” on Daesh tunnels in Afghanistan. All of those came during the heightened tensions with North Korea.

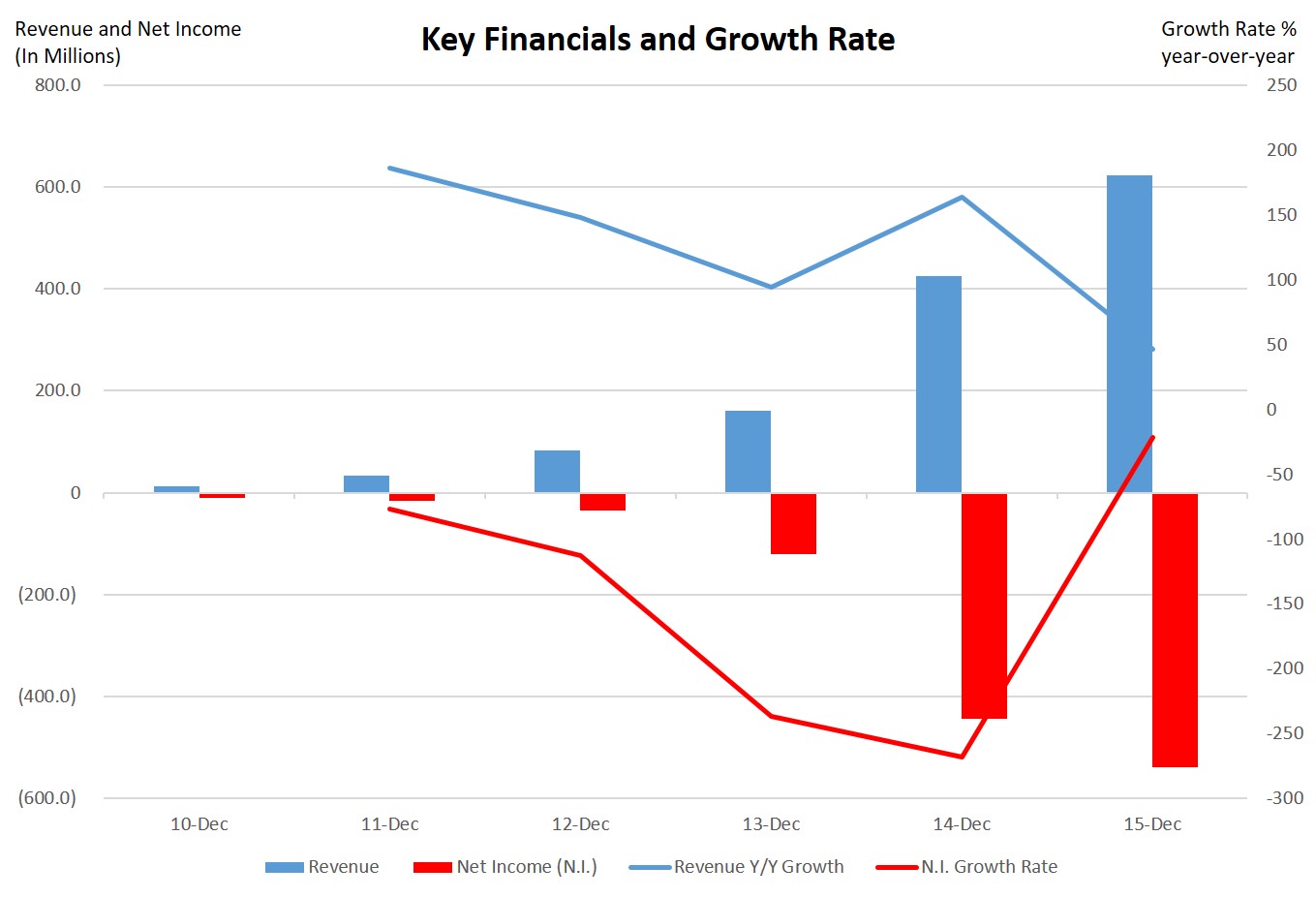

War is Good for the Cold-Hearted Stock Market

North Korea acting out is a good thing for America. War throughout the history has made us united. Not to mention that the stock market goes up.

The first circle represents the time of news reports on U.S. airstrikes on Syrian bases.

The second circle represents the time of news reports on most powerful non-nuclear bomb being dropped in Afghanistan

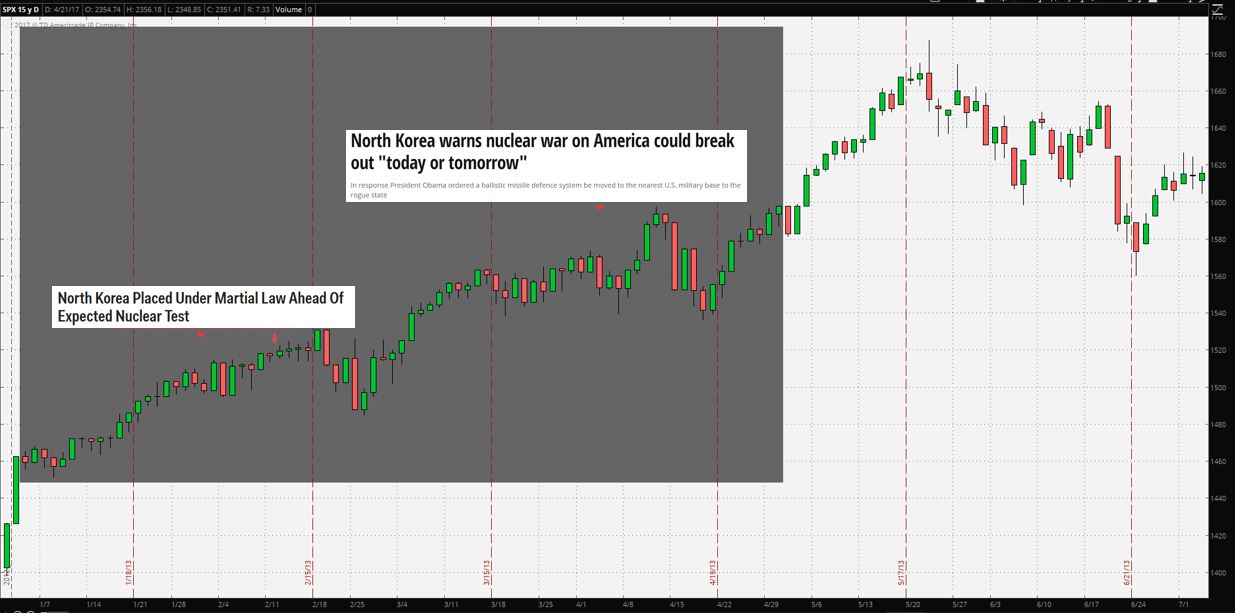

As you can see in figure 2, the stock market barely reacted to the recent U.S. military actions that Trump gave a green light to.

As a trader and investor, I wouldn’t be concerned about the potential war with North Korea. (Although I would be concerned about the loss of human lives and loss of limbs.)

In early 2013, there were increased tensions with North Korea, similar to today. At the time, the stock market did not give a damn about the threats from DPRK.

The first headline shows two arrows.

The first arrow represents when the headline came out. The second arrow represents February 12 when NK conducted the nuclear test.

The second headline represents North Korea threatening the west as usually.

Not only does the stock market not care about North Korea, but also for any other war in the past century. War is good for the cold-hearted stock market.

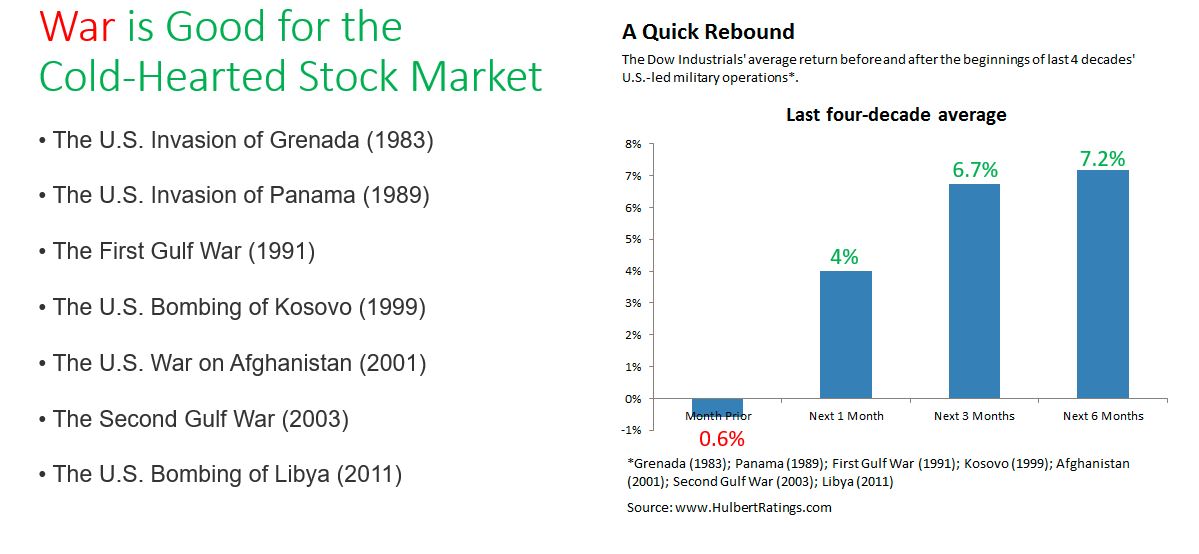

Over the past 4 decades, Dow Industrials on average was turned on by U.S.-led military operations, returning 4% in a month after the beginning of military operations and more afterward.

Recent Three Wars

When the U.S., with support from allies, started bombing against Taliban forces in Afghanistan on October 7, 2001, the stock market went up, not down. Even after 12 days later when the first wave of conventional ground forces arrived, the stock market kept going up. By the year-end when Taliban collapsed, S&P 500 was up about 14.5%.

When the U.S. began the major combat operations in Iraq on March 20, 2003, the stock market skyrocketed as shown in the candlestick bar on the highlighted portion of S&P 500 Weekly chart in figure 6 below. By the time the operations ended on May 1, the stock market was up about 11.5%.

On March 19th of 2011, multiple countries part of NATO intervened in Libya. By the end of intervention on October 31st, the market slid 20%. The drop cannot be blamed on the NATO-led forces. This was due to the fears of contagion of the European debt crisis and first-ever downgrade of U.S. AAA credit rating.

The only difference this time is we got leaders who very much loves forces and are violent themselves. Another difference is that North Korea is little powerful today than they were in 2013. But they are very weak compared to China, Russia, Europe, and U.S. It’s better to act now before North Korea gets even stronger. Although lives and limbs will be lost, I think there’s a greater cost if we allow North Korea to get even stronger.

China and North Korea

With China possibly increasingly going against North Korea, Kim Jong-un might act even more violent. I don’t think China really wants to break off its relationship DPKR due to the geographic proximity and China’s willingness to make more friends in the region. Besides being a military and diplomatic ally, China is also an economic ally. In 2015, the second largest economy accounted for 83%, or $2.34 billion, of the North Korea’s exports.

In late February, China sanctioned coal shipments from North Korea, who is a significant supplier of coal. Instead, China has been ordering the coal from the U.S. In the past, Trump said he wants to help the country’s struggling coal sector.

As Reuters reported, Thomson Reuters Eikon data shows “no U.S. coking coal was exported to China between late 2014 and 2016, but shipments soared to over 400,000 tonnes by late February.”

Is China having a change of heart on its relationship with North Korea? I don’t think as China’s trade with North Korea still increased by almost 40% in the first quarter of this year. China also buys other stuff, such as minerals and seafood. Looks like China wants to be on the good side of North Korea and Trump. The Art of the Deal.

Is this time is also different when it comes to the stock market? I don’t believe so. I’m not worried about the negative impact on the stock market due to North Korea, even though they were to be invaded.

However, I’m watching very cautiously China and Russia getting into an armed conflict with the U.S because of the North Korea situation. Armed conflict between the superpowers is a game changer. Although that’s very unlikely as superpowers argue all the time.

Suggestion For Your Portfolio

The situations might affect the markets for a very short period of time, especially if there’s uncertainty. But investors shouldn’t worry about it. The market could care less about a war, specifically when it’s aboard.

During the times of war, don’t reduce your holdings because of misconception war is bad. If you do, you will miss the gains.

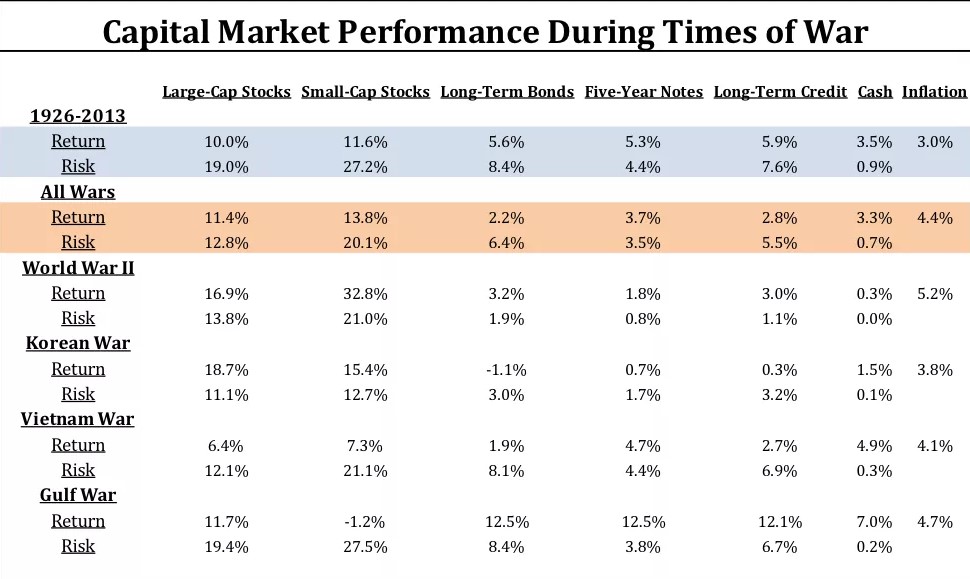

Sources: The indices used for each asset class are as follows: the S&P 500 Index for large-Cap stocks; CRSP Deciles 6-10 for small-cap stocks; long-term US government bonds for long-term bonds; five-year US Treasury notes for five-year notes; long-term US corporate bonds for long-term credit; one-month Treasury bills for cash; and the Consumer Price Index for inflation. All index returns are total returns for that index. Returns for a war-time period are calculated as the returns of the index four months before the war and during the entire war itself. Returns for “All Wars” are the annualized geometric return of the index over all “war-time periods.” Risk is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results.