My finals at Baruch College are over. I’m back now. In this post, I will write about November jobs report. On the next post, I will be writing about the European Central Bank (ECB), the Fed and the risks for a rate increase.

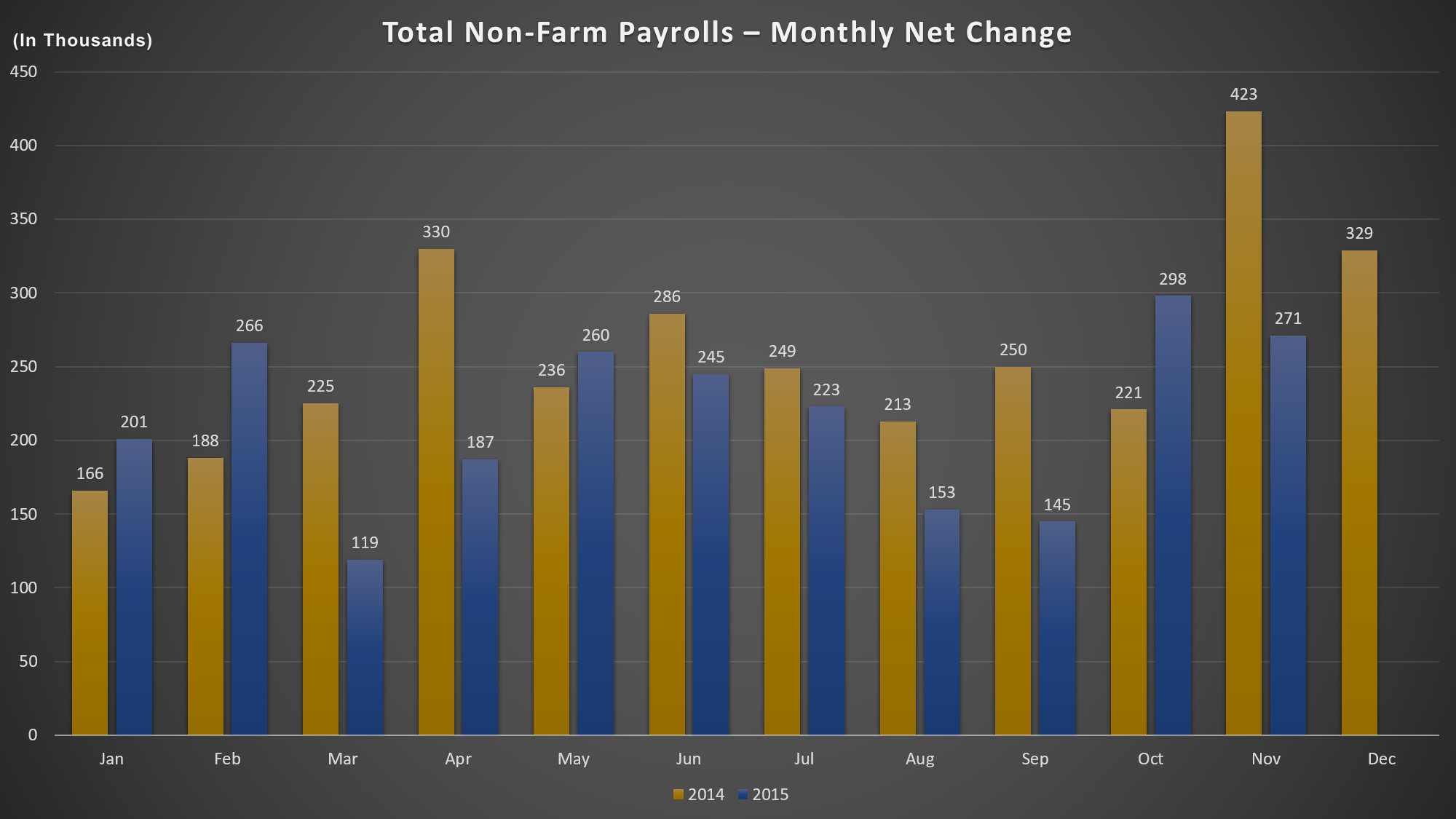

On December 4, the United States Department of Labor reported November payroll numbers, which was stronger than expected. There was 211K jobs added in November, stronger than expected and the second consecutive month increase above 200K. Additionally, September and October payrolls were revised higher by 35K. September was revised higher from 137K to 145K (+8K) and November from 271K to 298K (+27K). Over the past 12 months, an average monthly job gain was 237K, little higher than the 224K average in the same period of 2014. Year-to-date, however, only 210K jobs were added every month on average, compared to 253K last year for the same period.

I believe this hiring pace is only temporary due to holidays. A lot of employers, especially large department retailers, are adding temporary or “seasonal” workers. Retail trade payrolls rose 31K as retailers ramped up seasonal hiring.

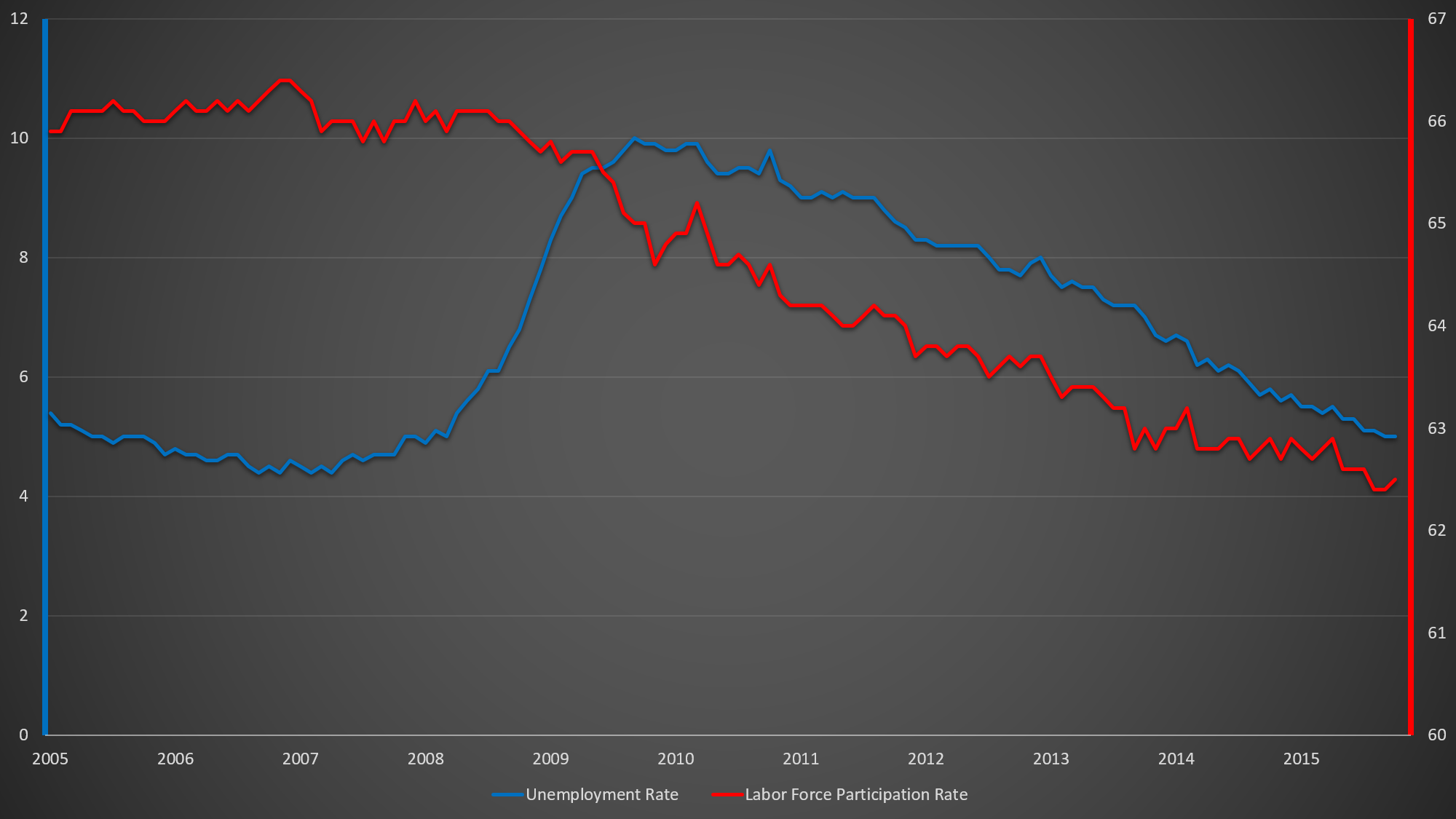

The unemployment remained at a April-2008 low of 5%. The labor-force participation rate ticked up 0.1% higher from 38-year (1977) low of 62.4% to 62.5%. In a typical business cycle, the labor-force participation rate rises when the economy is growing reboustly. While this participation rate ticked higher, we should not get our hopes up. It has been in a long-term decline since the financial crisis of 2008. One month of data is not enough.

One interesting thing to note is the U-6 unemployment rate, or the underemployment. It is a broader measure of unemployment, which includes people who aren’t looking for work and those who are working fewer hours than they wish. An individual with a master’s degree working as a bus driver is considered to be underemployed. U-6 ticked up to 9.9% in November from 9.8% in October, but down from 11.4% a year ago. If it increases again in December, I look that as a sign that the economy is about to get worse. If it continues to increase and increase, the economy is headed for a trouble.

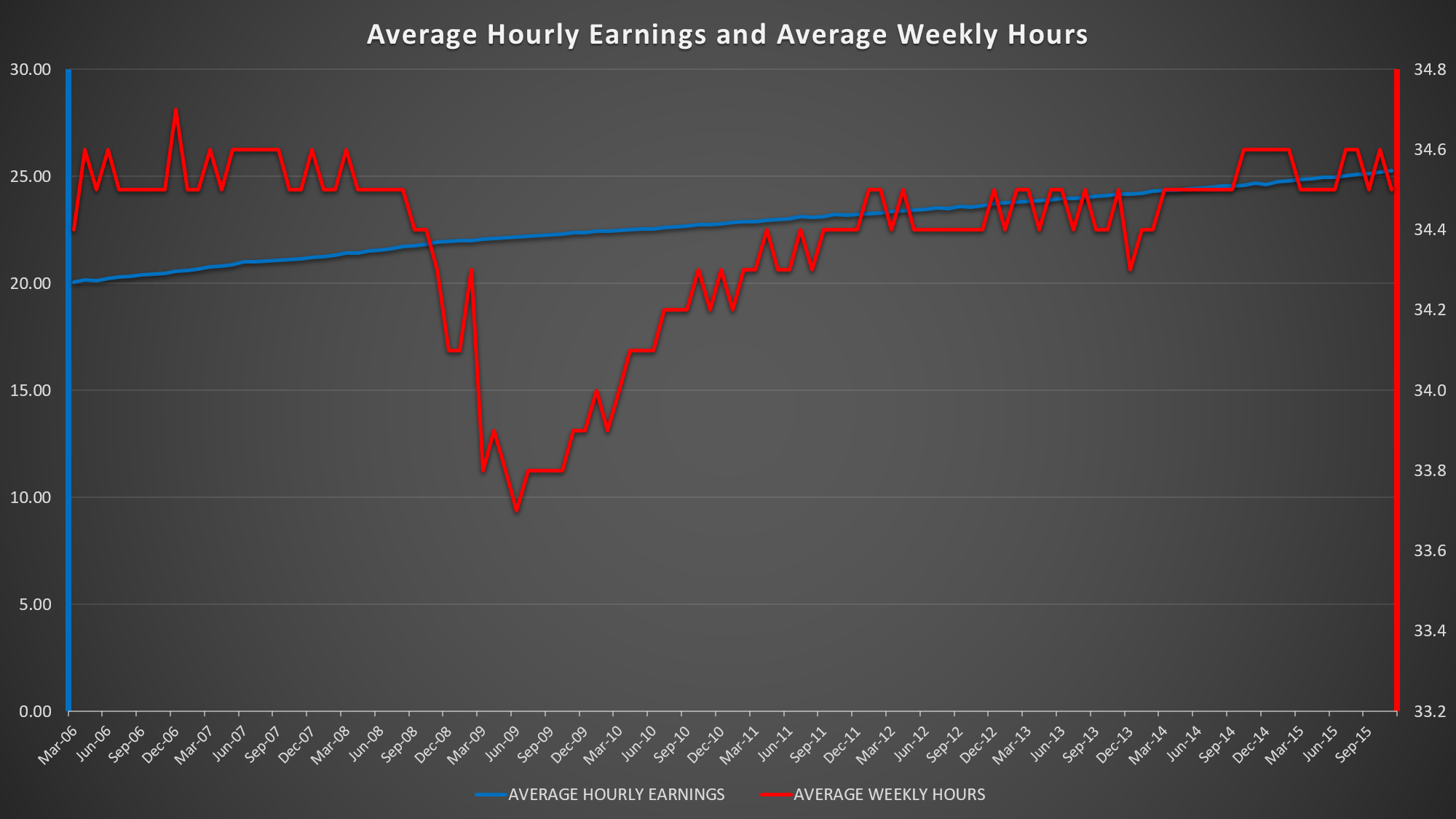

Average hourly earnings rose by 4 cents, or 0.2% to $25.25, following a 9-cent gain in October. Half of the monthly gain in November compared to October, pulled down the annual rate down from 2.5% to 2.3%. Average weekly hours worked fell 0.1 hours from 34.6 to 34.5.

While increasing wages are good news, increases in minimum wages are dreadful for the economy in the long run. I previously stated in “October Jobs Report Strong: It is Just One Report” post,

“…wage growth might suggest that employers are having trouble finding new workers (should I say “skilled” workers) and they have to pay more to keep its workers and/or to get new skilled workers. This could draw more people back into the labor market, increasing the participation rate. Without the right skills, good luck.”

“Without the right skills, good luck.” Any escalation in minimum wages will cause more students to drop out to work at “no-skill needed” and/or “low-skill needed” places.

Young people should not drop out just to work at Mcdonald, Costco, etc, as a “minimum wage” employee. They need skills. Skills that will be very useful for their future. Not flipping burger skills.

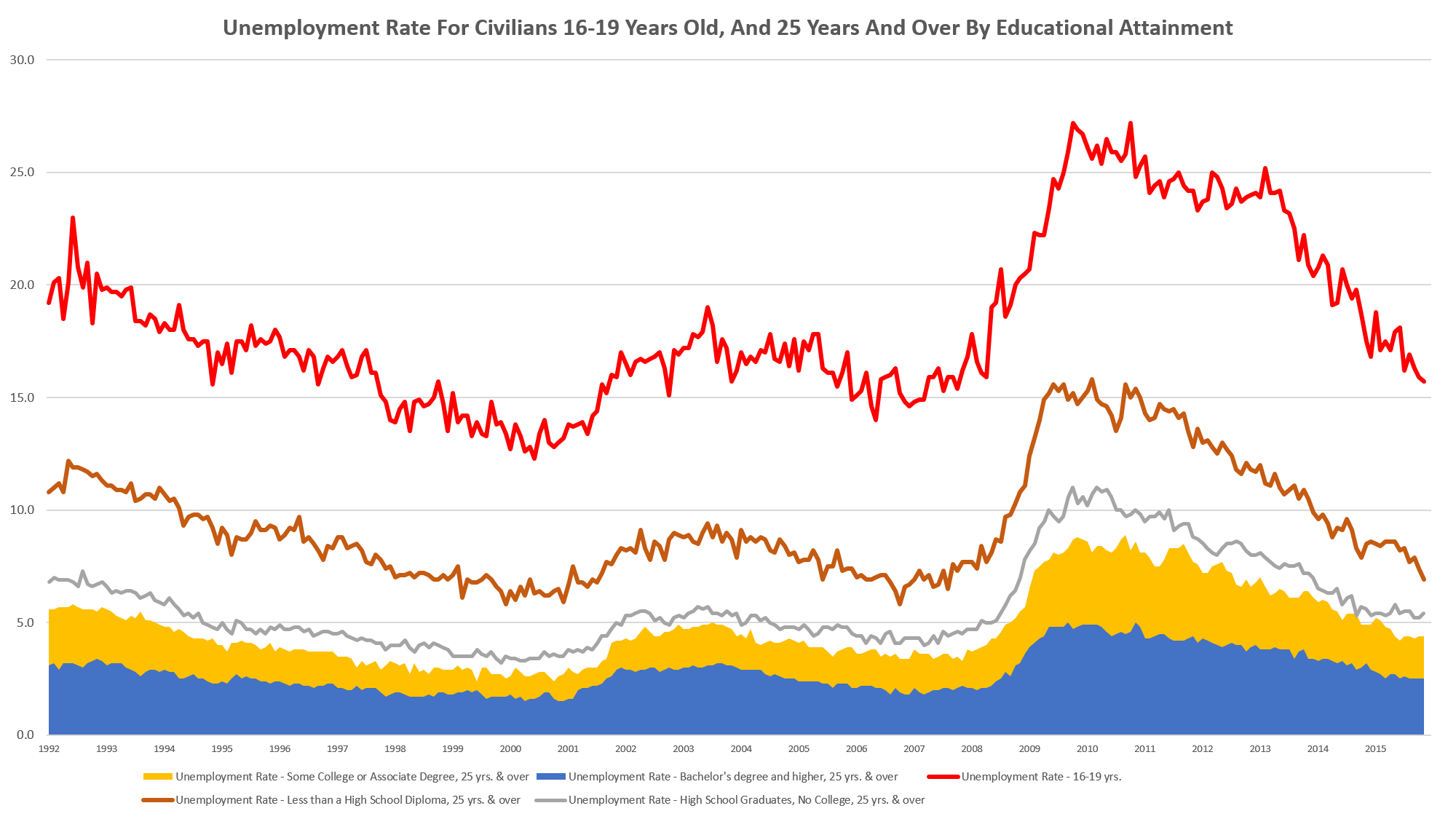

You see the red line on a graph above? That’s the unemployment rate for 16-19 years old in the past two decades. The lower the education attainment, the higher the unemployment rate.

Don’t forget the threat of technology. Do not underestimate the power of technology. McDonald has already rolled out and are rolling out self-service kiosks in restaurants. In other words, replace the “minimum-wage” employees with technology.

While this is a strong jobs report again, it is time to change. Holiday season is nearing its end. Technology continues to destroy more jobs than it is creating. Back to “normal” jobs report and “poor” jobs report series, starting next month.