15 seconds and counting

12….11…10…9….IGNITION SEQUENCE START….6….5….4….3….2….1….0….ALL ENGINES RUNNING….LIFTOFF….WE HAVE A LIFTOFF!

The Fed finally raised rates after nearly a decade. On December 16, the Fed decided to raise rates – for the first time since June 2006 – by 0.25%, or 25 basis points. It was widely expected by the markets and I only expected 10bps hike. Well, I was wrong on that.

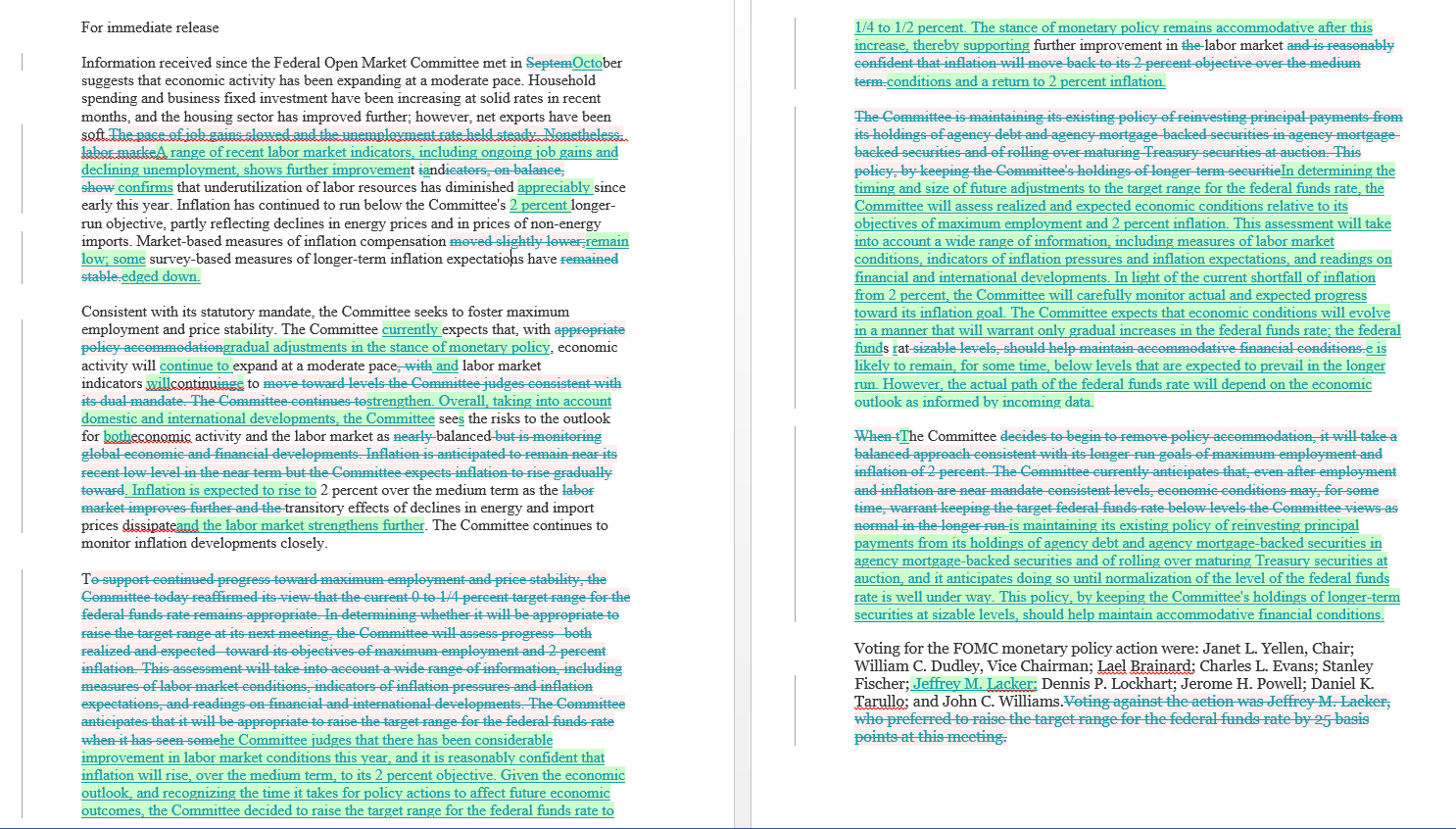

The Federal Open Market Committee (FOMC) unanimously voted to set the new target range for the federal funds rate at 0.25% to 0.50%, up from 0% to 0.25%. In the statement, the policy makers judged the economy “has been expanding at a moderate pace.” Labor market had shown “further improvement.” Inflation, on the other hand, has continued to “run below Committee’s 2 percent longer-run objective” mainly due to low energy prices.

Remember when the Fed left rates unchanged in September? It was mainly due to low inflation. What’s the difference this time?

In September, the Fed clearly stated “…survey—based measures of longer-term inflation expectations have remained stable.”

Now, the Fed clearly states “…some survey-based measures of longer-term inflation expectations have edged down.”

So…umm…why did they raise rates this time?

Here is a statement comparison from October to December:

Source: WSJ

On the pace of rate hikes looking forward, the FOMC says:

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

They clearly stated one of the things they look for, which is inflation expectations. But, they also did state that “inflation expectations have edged down.”

It seems to me that the Fed did not decide to raise rates. The markets forced them. Fed Funds Futures predicted about 80% chance of a rate-hike this month. If the Fed did not raise rates, they would have lost their credibility.

I believe the Fed will have to “land” (lower back) rates this year, for the following reasons:

- Growing Monetary Policy Divergence

On December 3, European Central Bank (ECB) stepped up its stimulus efforts. The central bank decided to lower deposit rates by 0.10% to -0.30%. The purpose of lower deposit rates is to charge banks more to store excess reserves, which stimulates lending. In other words, free money for the people so they can spend more and save less.

ECB also decided to extend Quantitative Easing (QE) program. They will continue to buy 60 billion euros ($65 billion) worth of government bonds and other assets, but until March 2017, six months longer than previously planned, taking the total size to 1.5 trillion euros ($1.6 trillion), from the previous $1.2 trillion euros package size. During the press conference, ECB President Mario Draghi said the asset eligibility would be broadened to include regional and local debt and signaled QE program could be extended further if necessary.

ECB might be running out of ammunition. ECB extending its purchases to regional and local debt raises doubts about its program.

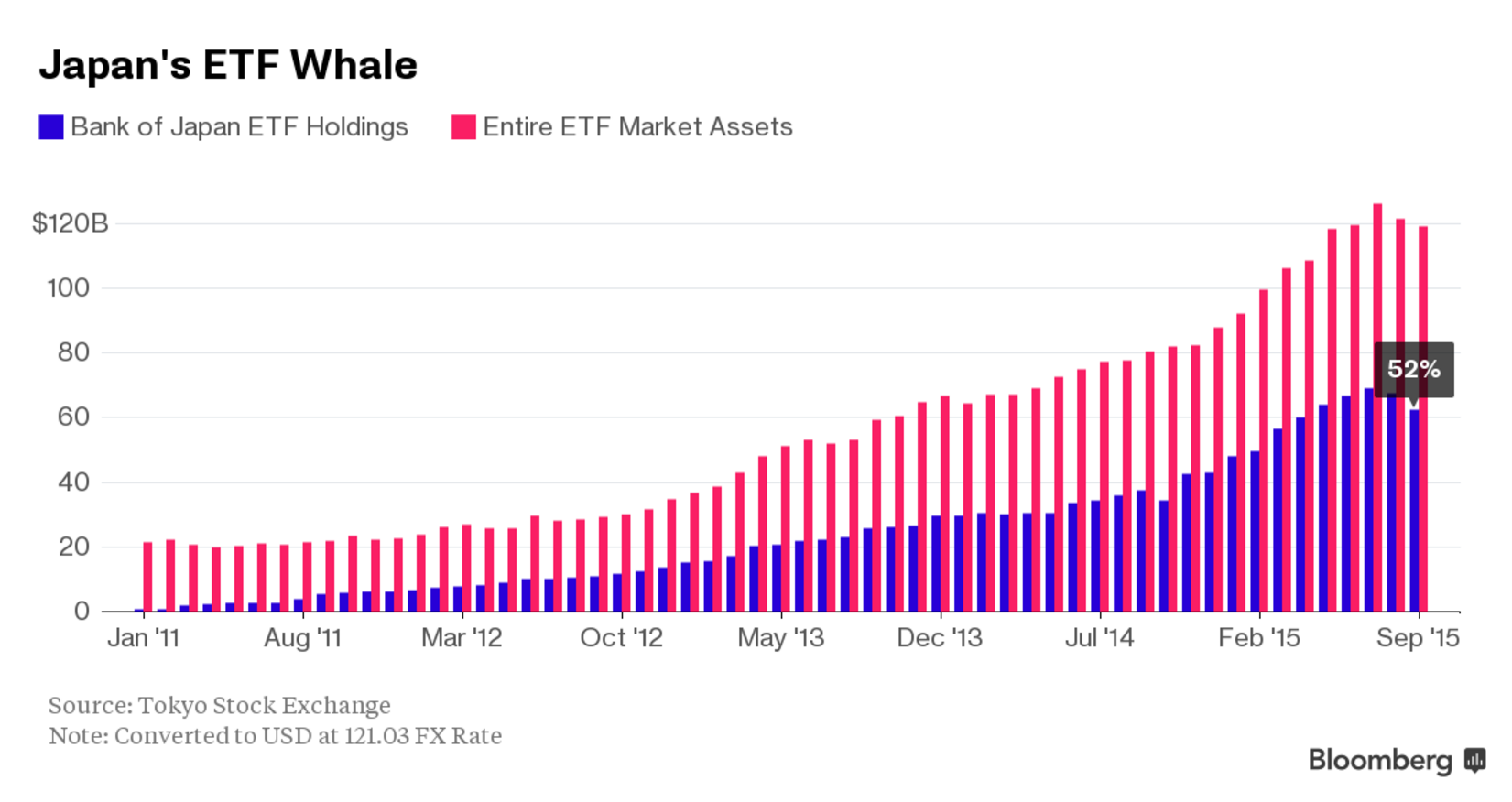

Not only ECB is going the opposite direction of the Fed. Three weeks ago, Bank of Japan (BoJ) announced a fresh round of new stimulus. The move was hardly significant, but it is still a new round of stimulus. The central bank decided to buy more exchange-traded fund (ETF), extend the maturity of bonds it owns to around 7-12 years from previously planned 7-10 years, and increase purchases of risky assets.

I previously stated in “Central Banks Smash: No Growth, No Inflation“,

The extensions of its QE are beginning to become routine or the “new normal”.

Source: Bloomberg

The move by BoJ exposes the weakness of its past actions. It suggests the bank is also out of ammunition. Already owning 52% or more of the Japan’s ETF market and having a GDP-to-Debt ratio around 245%, it is only a matter of time before Japan’s market crashes. Cracks are already beginning to be shown. I expect the market crash anytime before the end of 2019.

So, what are the side-effects of these growing divergence?

For example, the impact of a US dollar appreciation resulting from a tightening in US monetary policy and the impact of a depreciation in other currencies resulting from easing in its monetary policies. Together, these price changes will shift global demand – away from goods and services produced here in the U.S. and toward those produced abroad. In others words, US goods and services become more expensive abroad, leading to substitution by goods and services in other countries. Thus, it will hurt the sales and profits of U.S. multinationals. To sum up everything that is said in this paragraph, higher U.S. rates relative to rates around the global harms U.S. competitiveness.

- Emerging Markets

Emerging markets were trouble last year. It is about to get worse.

International Monetary Fund (IMF) decided to include China’s currency, renminbi (RMB) or Yuan, to its Special Drawing Rights (SDR) basket, a basket of reserve currencies. Effective October 1, 2016, the Chinese currency is determined to be “freely usable” and will be included as a fifth currency, along with the U.S. dollar, euro, Japanese yen, and pound sterling, in the SDR basket.

“Freely useable” – not so well defined, is it?

Chinese government or should I say People’s Bank Of China (PBOC), cannot keep its hands off the currency (yuan). It does not want to let market forces take control. They think they can do whatever they want. As time goes on, it is highly unlikely. As market forces take more and more control of its exchange-rate, it will be pushed down, due to weak economic fundamentals and weak outlook.

China, no need to put a wall to keep market forces out. Let the market forces determine the value of your currency. It is only a matter of time before they break down the wall.

In August, China changed the way they value their currency. PBOC, China’s central bank, said it will decide the yuan midpoint rate based on the previous day’s close. In daily trading, the yuan is allowed to move 2% above or below the midpoint rate, which is called the daily fixing. In the past, the central bank used to ignore the daily moves and do whatever they want. Their decision to make the midpoint more market-oriented is a step forward, but they still have a long way to go.

China saw a significant outflows last year. According to Institute of International Finance (IFF), an authoritative tracker of emerging market capital flows, China will post record capital outflows in 2015 of more than $500 billion. The world’s second largest economy is likely to see $150 billion in capital outflow in the fourth quarter of 2015, following the third quarter’s record $225 billion.

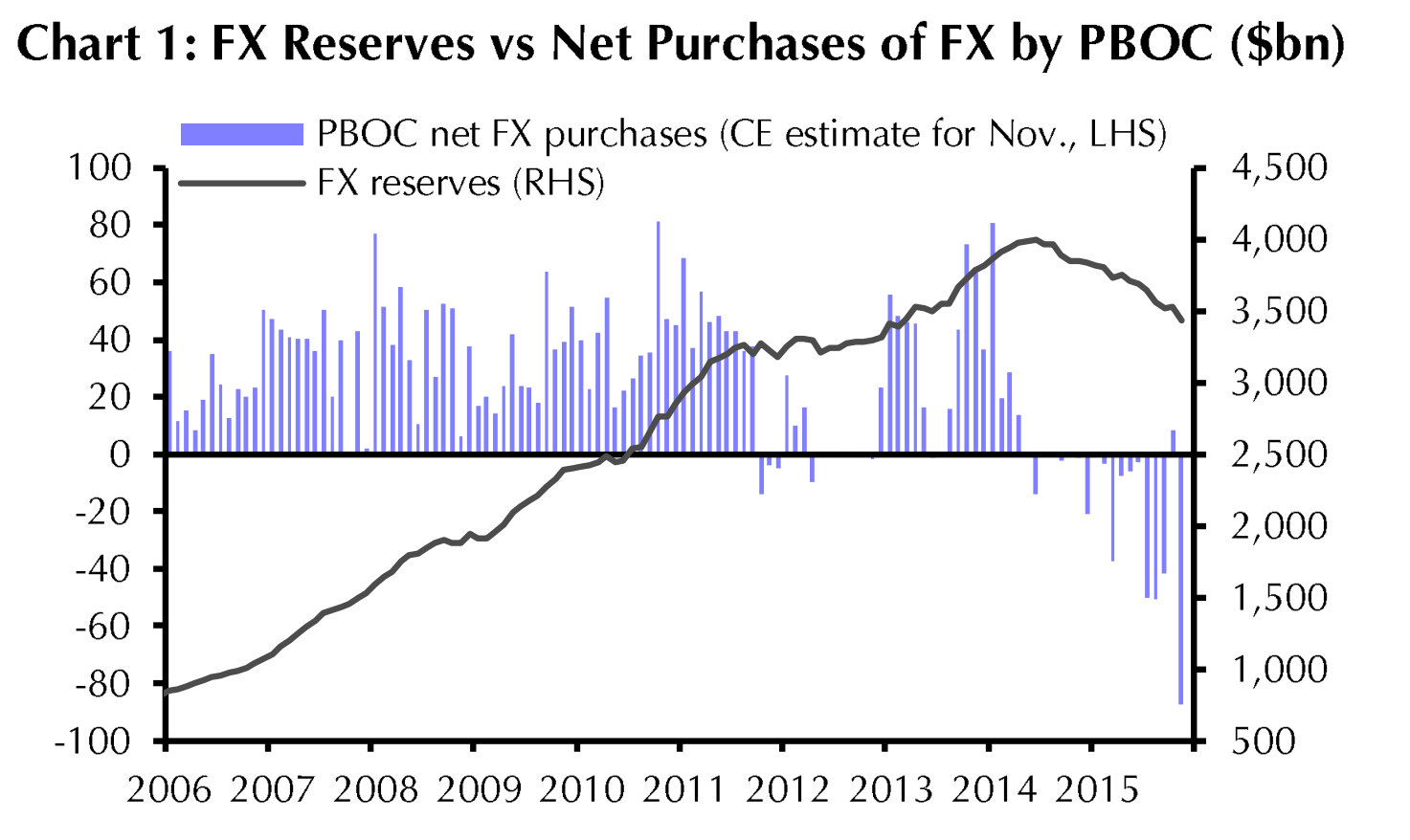

Ever since the devaluation in August, PBOC has intervened to prop yuan up. The cost of such intervention is getting expensive. The central bank must spend real money during the trading day to guide the yuan to the level the communists want. Where do they get the cash they need? FX reserves.

China’s foreign-exchange reserves, the world’s largest, declined from a peak of nearly $4 trillion in June 2014 to just below $3.5 trillion now, mainly due to PBOC’s selling of dollars to support yuan. In November, China’s FX (forex) reserves fell $87.2 billion to $3.44 trillion, the lowest since February 2013 and largest since a record monthly drop of $93.9 billion in August. It indicates a pick-up in capital outflows. This justifies increased expectations for yuan depreciation. Since the Fed raised rates last month, I would not be surprised if the capital flight flies higher, leading to a weaker yuan.

Source: Capital Economics

Depreciation of its currency translates into more problems for “outsiders,” including emerging markets (EM). EMs, particularly commodities-linked countries got hit hard last year as China slowed down and commodity prices slumped. EMs will continue to do so this year, 2016.

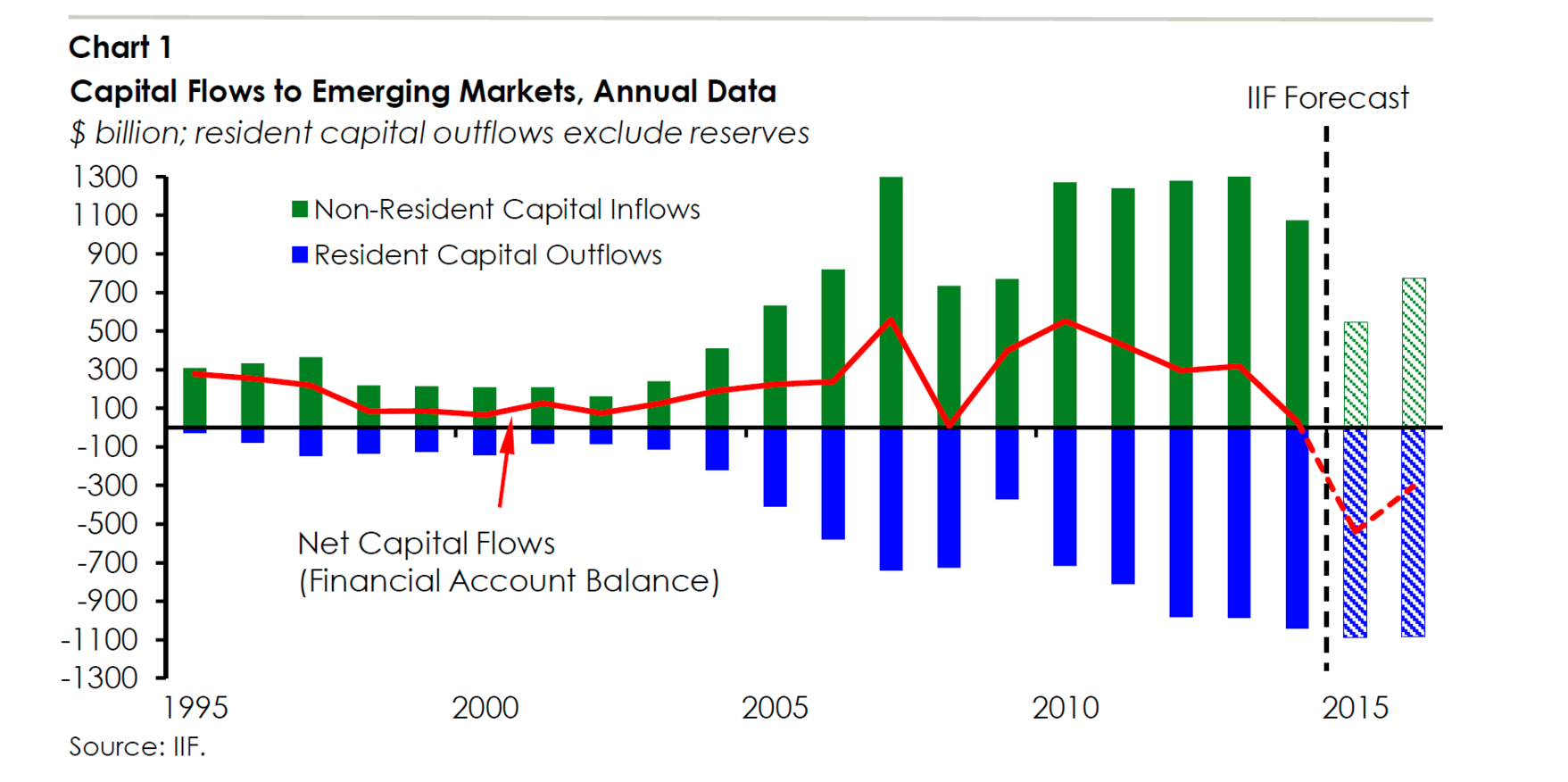

The anticipation of tightening in the U.S. and straightening dollar put a lot of pressure on EM. EM have seen a lot of significant capital outflows because they carry a lot of dollar denominated debt. According to the October report from IFF, net capital flows to EM was negative last year for the first time in 27 years (1988). Investors are estimated to pull $540 billion from developing markets in 2015. Foreign inflows will fall to $548 billion, about half of 2014 level and lower than levels recorded during the financial crisis in 2008. Foreign investor inflows probably fell to about 2% of GDP in emerging markets last year, down from a record of about 8% in 2007.

Source: IFF, taken from Bloomberg

Also contributing to EM outflows are portfolio flows, “the signs are that outflows are coming from institutional investors as well as retail,” said Charles Collyns, IIF chief economist. Investors in equities and bonds are estimated to have withdrawn $40 billion in the third quarter, the worst quarterly figure since the fourth quarter of 2008.

A weaker yuan will make it harder for its main trading partners, emerging markets and Japan, to be competitive. This will lead to central banks of EM to further weaken their currencies. Japan will have no choice but to keep extending their QE program. And to Europe. And to the U.S. DOMINO EFFECT

Why are EMs so important? According to RBS Economics, EMs have accounted for 50%-60 of global output and 70% of global economic growth each year since the 2008 crisis.

Source: RBS Economics

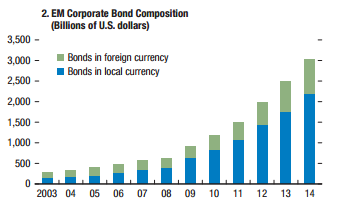

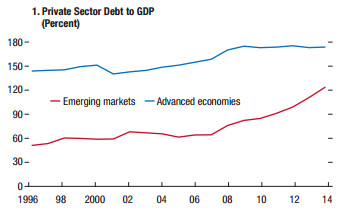

Some EM investors, if not all, will flee as U.S. rates rise, compounding the economic pain there. Corporate debt in EM economies increased significantly over the past decade. According to IMF’s Global Financial Stability report, the corporate debt of non-financial firms across major EM economies increased from about $4 trillion in 2004 to well over $18 trillion in 2014.

When you add China’s debt with EM, the total debt is higher than the market capitalization. The average EM corporate debt-to-GDP ratio has also grown by 26% the same period.

The speed in the build-up of debt is distressing. According to Standard & Poor’s, corporate defaults in EM last year have hit their highest level since 2009, and are up 40% year-over-year (Y/Y).

Source: WSJ

According to IFF (article by WSJ), “companies and countries in EMs are due to repay almost $600 billion of debt maturing this year….of which $85 is dollar-denominated. Almost $300 billion of nonfinancial corporate debt will need to be refinanced this year.”

I would not be surprised if EM corporate debt meltdown triggers sovereign defaults. As yuan weakens, Japan will be forced to devalue their currency by introducing me QE which leaves EMs with no choice. EMs will be forced to devalue their currency. Devaluations in EM currencies will make it much harder (it already is) for EM corporate borrowers to service their debt denominated in foreign currencies, due to decline in their income streams. Deterioration of income leads to a capital flight, pushing down the value of the currency even more, which leads to much more capital flight.

Let IMF explain the situation in EM,

“Firms that have borrowed the most stand to endure the sharpest rise in their debt-service costs once interest rates begin to rise in some advanced economies. Furthermore, local currency depreciations associated with rising policy rates in the advanced economies would make it increasingly difficult for emerging market firms to service their foreign currency-denominated debts if they are not hedged adequately. At the same time, lower commodity prices reduce the natural hedge of firms involved in this business.”

According to its Global Financial Stability report, EM companies have an estimated $3 trillion in “overborrowing” loans in the last decade, reflecting a quadrupling of private sector debt between 2004 and 2014.

(Billions of U.S. dollars) – Page 86

(Percent – Page 11

Rising US rates and a strengthening dollar will make things much worse for EMs. Jose Vinals, financial counsellor and director of the IMF’s Monetary and Capital Markets Department, said in his October article, “Higher leverage of the private sector and greater exposure to global financial conditions have left firms more susceptible to economic downturns, and emerging markets to capital outflows and deteriorating credit quality.”

I believe currency war will only hit “F5” this year and corporate defaults will increase, leading to the early stage of sovereigns’ defaults. I would not be surprised if some companies gets a loan denominated in euros just to pay off the debt denominated in U.S dollars. That’s likely to make things worse.

Those are some of the risks I see that will force the Fed to lower back the rates. I will address more risks, including lack of liquidity, junk bonds, inventory, etc, in my next article. Thank you.

EXTRA: Market reactions,

EUR/USD:

USD/JPY:

10-Year Treasury Index:

2-Year U.S. Treasury Note Futures: