This article was initially posted on The Ticker, Baruch College’s (the college I currently attend) independent, student-run newspaper. I’m re-posting the article with small changes.

The European Central Bank cut all rates and expanded its quantitative easing program. Amid growing concerns about economic growth and inflation, the 19-country eurozone’s central bank cut its rates to an all-time low. The refinancing rate, the rate of interest that banks must pay when they borrow funds from the ECB, was decreased by 5 basis points to zero percent. The marginal lending facility, the rate at which the central bank offers overnight credit to banks, was decreased by 5 basis points to 0.25 percent.

The deposit rate was cut further into negative territory. As expected by markets, the central bank cut its deposit rate by 10 basis points to negative 0.4 percent. The purpose of lower interest rates is to boost lending by encouraging banks to lend more to businesses and consumers, which in turn boosts spending and investment. In 2014, household consumption expenditure and investment accounted for 56.5 percent of GDP and 18 percent of GDP, respectively. QE was expanded from 20 billion euros to 80 billion euros ($89 billion) starting in April.

Under QE, the eurozone central bank pumps money into the region by buying assets, such as bonds, in the expectation that the proceeds will be invested in the European economy. In addition to bonds issued by financial institutions, QE will now include bonds issued by non-financial corporations.

“Rates will stay low, very low, for a long period of time, and well past the horizon of our purchases,” said Draghi, president of the central bank, referring to the QE. Its asset purchase program, or the QE, is expected to run until at least March 2017.

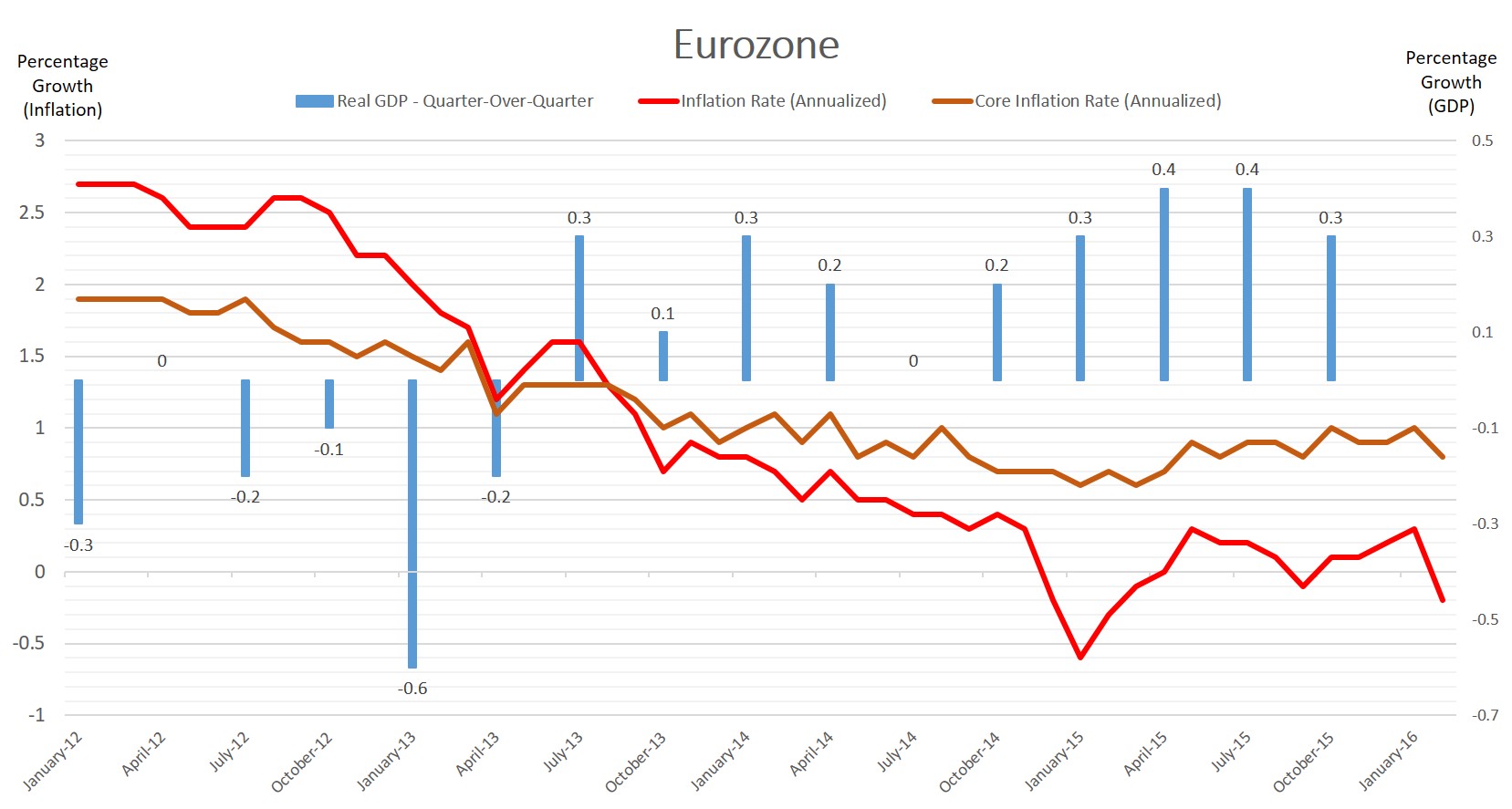

Policymakers have come under growing pressure to increase monetary stimulus after the eurozone slipped back into negative inflation in February.According to an early estimate by statistics office Eurostat, annual inflation dropped to negative 0.2 percent in February, down from 0.3 percent in January, the worst reading since February of last year.

That is far below the central bank’s inflation target of just under 2 percent. Draghi stated, “While very low or even negative inflation rates are unavoidable over the next few months, as a result of movements in oil prices, it is crucial to avoid second-round effects by securing the return of inflation to levels below, but close to, 2 percent without undue delay.”

Low energy prices were the main factor behind the drop in headline inflation. Energy prices fell 8 percent, down from a contraction 5.4 percent in January. Core inflation, which excludes food and energy, dropped 0.8 percent, down from 1 percent in January—the lowest since April of last year.

Lower core inflation reading suggests that the low energy prices are already feeding into the price of other goods and services, creating what Draghi called second-round effects that could lead to even lower inflation and eventually lead to deflation.

“Inflation rates are expected to remain at negative levels in the coming months and to pick up later in 2016,” said Draghi. The central bank lowered its inflation forecast for this year to 0.1 percent from the 1 percent previously predicted. In 2017, the inflation is forecasted to be at 1.3 percent. The previous forecast was for 1.6 percent.

Source: Eurostat

Reflecting weaker economic prospects around the globe and low energy prices, the growth outlook was also lowered. Gross domestic product is projected to expand 1.4 percent this year, lower than a previous forecast of 1.7 percent.

In 2017, it is projected to expand 1.7 percent, lower than a previous forecast of 1.9 percent. Kenneth Tjonasam, a 27-year-old Baruch College senior majoring in finance, believes the central bank is running out of viable solutions.

He stated, “I believe the ECB moves are unprecedented. I’m starting to think they have run out of viable patient solutions to address the slow growth in aggregate demand.”

European markets soared and the euro weakened in a reaction to the rate cuts and expansion of QE, but they reversed when Draghi suggested no further rate cuts. “We don’t anticipate that it will be necessary to reduce rates further,” said Draghi. Then, European markets fell back and the euro soared.

In order to further ease private sector credit conditions, the central bank also decided to offer eurozone financial institutions ultra-cheap four-year loans. The central bank said the interest rate on the loans “can be as low as the rate on the deposit facility,” meaning the eurozone banks could get paid to take the loans.

The purpose is to boost lending to consumers and companies. There is no guarantee they will borrow the money.

The European Central Bank will meet again on April 21. No further stimulus is expected at the moment.